Use collaborative features in FreshBooks to help your client run their business more efficiently and work with you more effectively.

So, you’ve got a client using FreshBooks for their small business. How can you make the most of the accounting software for them, and for you?

We’ve outlined features in FreshBooks that you can use together with your clients to make you both more productive. Beyond just saving time and money, these tools will help you bring more value to the table and build lasting client relationships.

Table of Contents

1. Set Up Your Accountant Role in FreshBooks

If you don’t have access to your client’s FreshBooks account, you’ll first need to be invited by them in order to access their account information. There is no cost to your client to add you as an Accountant.

If your client isn’t sure how to do this, send them these instructions for inviting a Team Member.

Once you receive their invitation in your email, follow the steps for getting started as an Accountant (go to Set Up) to create your profile (if you’re new to FreshBooks) and access their account.

Permissions for Accountants in FreshBooks

What you and your client see in their account is slightly different. In most cases, your client will have an Owner role. This gives them full access to everything in their account, including Advanced Accounting [beta] features. Less accounting-savvy Owners can turn off Advanced Accounting, which means they won’t have the ability to add and edit custom Accounts in the Chart of Accounts or create Journal Entries, but the Accountant still has this ability.

In addition to the Accountant role, FreshBooks has a dual Admin-Accountant role. This is available to FreshBooks-certified Accounting Partners only. It gives you admin-level access to your client’s account as well as comprehensive training in the FreshBooks platform.

Learn more about becoming a FreshBooks Accounting Partner.

Here is an overview of the roles and permissions for accounting professionals:

2. Establish the Foundation of a Collaborative Workflow

Ideally, you and your client discuss roles and responsibilities up front in your service agreement. Which services will they take on, and which will you handle?

We recommend a collaborative accounting model (aka, modern accounting model). In this model, clients do much of the day-to-day bookkeeping themselves, so you can focus on higher-value, advisory-based services.

This doesn’t only benefit you. It empowers your client to be involved in their own accounting so they have a better understanding of their business finances. They are an active part of their own success. And they’re investing their money more wisely by paying you for valuable insight rather than grunt work.

FreshBooks is uniquely positioned for this kind of shared workflow. Business owners who have been overwhelmed by other accounting software find FreshBooks intuitive. When your client has no trouble managing their own books, you can start providing real value.

(Learn how Megan Justice, EA, uses FreshBooks to reach clients who are intimidated by accounting.)

3. Break Up the Bookkeeping

The following are key areas where you can collaborate in FreshBooks. This is where clients can easily manage data entry and repetitive tasks, while accountants and bookkeepers take on more complex work at set times.

FreshBooks is designed to be easy for small businesses. So if you choose to work collaboratively, your client can manage:

- Invoicing and Payments

- Proposals and Estimates

- Managing Payroll (if they’ve set up an integration with Gusto or Payment Evolution)

Expense Management

Many small business owners struggle to maintain visibility on their expenses. FreshBooks makes it easy to see recent expenses, add new ones, and access detailed reports.

This video, for example, is great to share with clients to illustrate how expense categories are applied:

In FreshBooks, your client can connect a bank or credit card to automatically import and categorize transactions. You can help them set up these bank connections, or do it for them, as an Admin-Accountant.

After bank connections are in place, log into the platform together to go over common mistakes and best practices. With the basics down, clients should be able to take on the bulk of the expense management themselves, like logging and categorizing expenses, tracking mileage, and backing up data.

Then you can focus on reviewing expenses and categorization, properly allocating petty cash expenses like mileage, dealing with the fine-tuning and cleanup, and providing context.

Bank Reconciliation

As with Expenses, owners can easily DIY bank rec in FreshBooks. The process of matching and marking bank transactions in our software requires no specialized accounting knowledge.

Will they get it right every time? Of course not. That’s where you come in and complete the bank reconciliation, comparing against bank statements, adding missing entries, resolving exceptions, and creating Journal Entries where needed.

Project Management

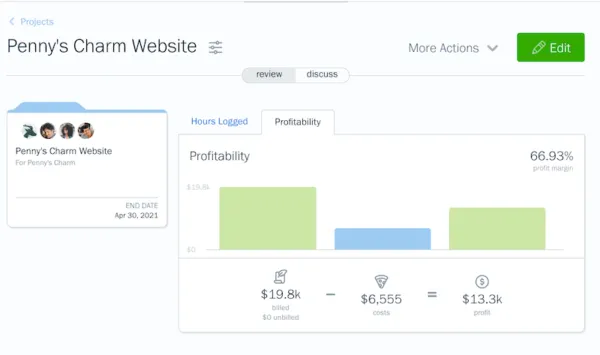

Projects are a way for your clients’ team members to collaborate inside of FreshBooks and communicate with their clients beyond invoices. They are also the building blocks for Profitability Reports in FreshBooks.

For each Project, your client sets billable rates, team member cost rates, and expense markups. A quick-glance Profitability tab compares revenues to costs for the Project.

The project management workflow lies almost entirely with your client. They and their team members will be responsible for the data entry—setting up the Projects and time tracking in the accounting software. (If you are set up as an Admin-Accountant, you can jump in to assist with this where needed.)

The accounting professional then provides advisory services based on that data, which might include pricing analysis, forecasting, and cash flow analysis.

4. Share the Tax Workload

Painless tax preparation is all about solid bookkeeping. Your client’s ability to keep their books in order year-round, using intuitive software like FreshBooks, will save you time when tax deadlines are approaching.

When you first start working with a client in FreshBooks, onboard them into best practices for setting up merchants, vendors, and sales tax as well as regularly tracking expenses and reconciling transactions.

Going into tax season, run tax reports and meet with clients to review them and discuss any findings. During this meeting you can also recategorize expenses, apply missing sales tax, and make other adjustments as needed.

5. Review Data and Reports Together

This is where you really prove your worth to your client—bringing it all back to KPIs at your monthly strategy meetings.

Data Analysis

FreshBooks has a number of integrations for analyzing and visualizing data pulled from your client’s account. This includes tools for building dashboards, pulling information into Google Sheets, and more.

Reports

FreshBooks has a suite of detailed and customizable reports for forecasting, auditing, and tax preparation. This includes:

- Invoice and Expense Reports

- Payments Reports

- Time Tracking and Project Reports

- Accounting Reports

You’ll of course be digging into the General Ledger and Trial Balance, but those may be less important for your client to keep tabs on.

Any of these reports can be valuable depending on your clients’ business, but the following are some that are the most important information to review together with your client. (Read about all FreshBooks reports here.)

Item Sales Report

Review this with your client to discuss the popularity of the items and services that make up their revenue streams.

Invoice Details Report

This report gives you a detailed summary of all invoices sent over a period of time. It’s a great opportunity to review with your client the correct way to charge sales tax on their invoices.

Payments Collected

You’ll want your client to be tracking their money coming in on a regular basis. Look at this report together for a summary of all the payments they’ve collected over a period of time.

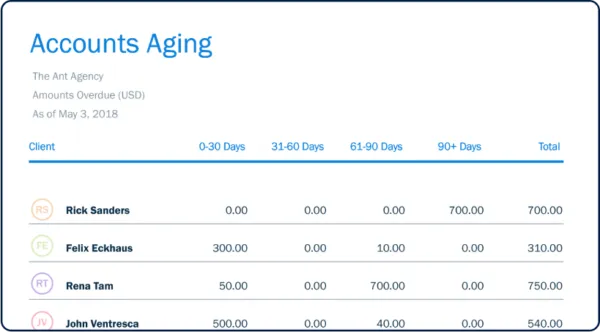

Accounts Aging and Accounts Payable Aging Reports

Walk your client through these reports to advise them on cash flow management.

Profitability Reports*

The data from your client’s Projects is pulled into 2 reports: the Profitability Summary Report and the Profitability Details Report. Review these with clients to see which projects are more profitable, to help them with forecasting.

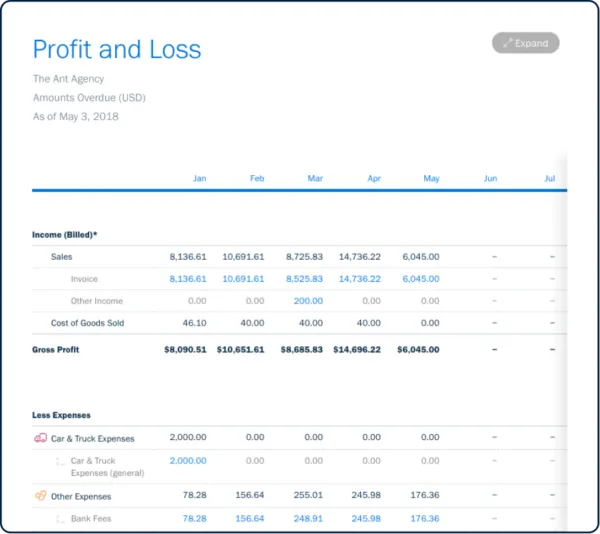

P&L Report

At least once a month, go over the P&L with your client to explain how income and expenses impact profit, taxes, and more.

Sales Tax Report

This report helps your client understand how much sales tax they’ve charged to their clients, and paid on expenses.

Cash Flow Report*

For small business owners, understanding cash flow is fundamental. Use this report—which includes all cash inflows and outflows—to show your client exactly how much cash they have on hand.

*available to FreshBooks users on Premium and higher plans

Reap the Rewards of Collaborative Workflows

The way you work with your clients is about so much more than ticking boxes to complete their bookkeeping. Establishing a shared workflow paves the way for better client relationships and a deeper financial knowledge for the business owner.

And when you’re spending less time on admin they can easily manage themselves in an intuitive accounting software like FreshBooks, you’re able to bring more value to your clients with advisory-based services.

To become a FreshBooks-certified accountant, join the Accounting Partner Program.

This post was updated in July 2022.

Written by Shannon Kelly, Senior Content Marketing Manager, FreshBooks

Posted on March 11, 2022

![An Accountant's Guide to Mastering FreshBooks [Free eBook]](https://www.freshbooks.com/blog/wp-content/uploads/2022/01/mastering-FB_Blog_Post_Image-226x150.png)