Finding an accountant is easy, but finding the right one for you and your business can be a challenge. Here's how to find a good accountant—and the key traits to look for.

Not every small business owner wants (or needs!) to know how to find a good accountant. And if you feel like it’s not the right fit for you, that’s totally fine.

But if you do decide that, come tax season, you need a little extra support (and let’s be real…who doesn’t?), it’s important to know the traits you should look for in a tax accountant, plus where and how to find the right one for your business.

Let’s take a deep dive into:

- How to find a good accountant

- The key traits you should look for

- How to choose the best accountant for you, your business, and your tax needs

Table of Contents

Why You Might Want to Hire a Tax Accountant

Before we jump into how to find a good accountant (and the traits you should look for), let’s quickly cover why you might want to consider hiring a tax accountant in the first place.

There are a variety of reasons why you might want to bring an accountant on board to support your business during tax season, including:

1. Business Taxes Are More Complex than Personal Taxes

While your personal taxes are probably fairly simple (which is why so many people take the DIY route), business taxes are a whole other beast.

Typically, even the most straightforward business taxes are going to be significantly more complicated than personal taxes. Tax accountants have plenty of experience navigating the complex world of business taxes, which means you don’t have to worry about navigating that complexity yourself.

2. Accountants Have Their Fingers on the Pulse of What’s Going on in the Tax World

Tax laws are in a constant state of flux, and if you don’t know how tax laws are changing and evolving, you risk:

- Making a mistake on your taxes

- Missing out on credits or deductions you might be eligible for

It’s your tax accountant’s job to know all the latest developments in the world of taxes, including any new laws, deductions, or credits. This means your business taxes will be completed with the most up-to-date information.

3. Making Mistakes on Your Taxes Can Cost You

Arguably the most common reason people hire tax accountants is to avoid mistakes. And for good reason! Filing inaccurate, incomplete or late business taxes can result in a variety of issues, including:

- Added penalties

- Steep fines

- An audit from the IRS

Tax accountants know the ins and outs of business taxes. And while there’s no guarantee that a tax accountant won’t make a mistake on your taxes, the chances of an error slipping through the cracks (and making its way to the IRS) are far less likely when you hire a professional.

Clearly, there are plenty of reasons to hire an accountant to do your taxes. But how, exactly, do you do that?

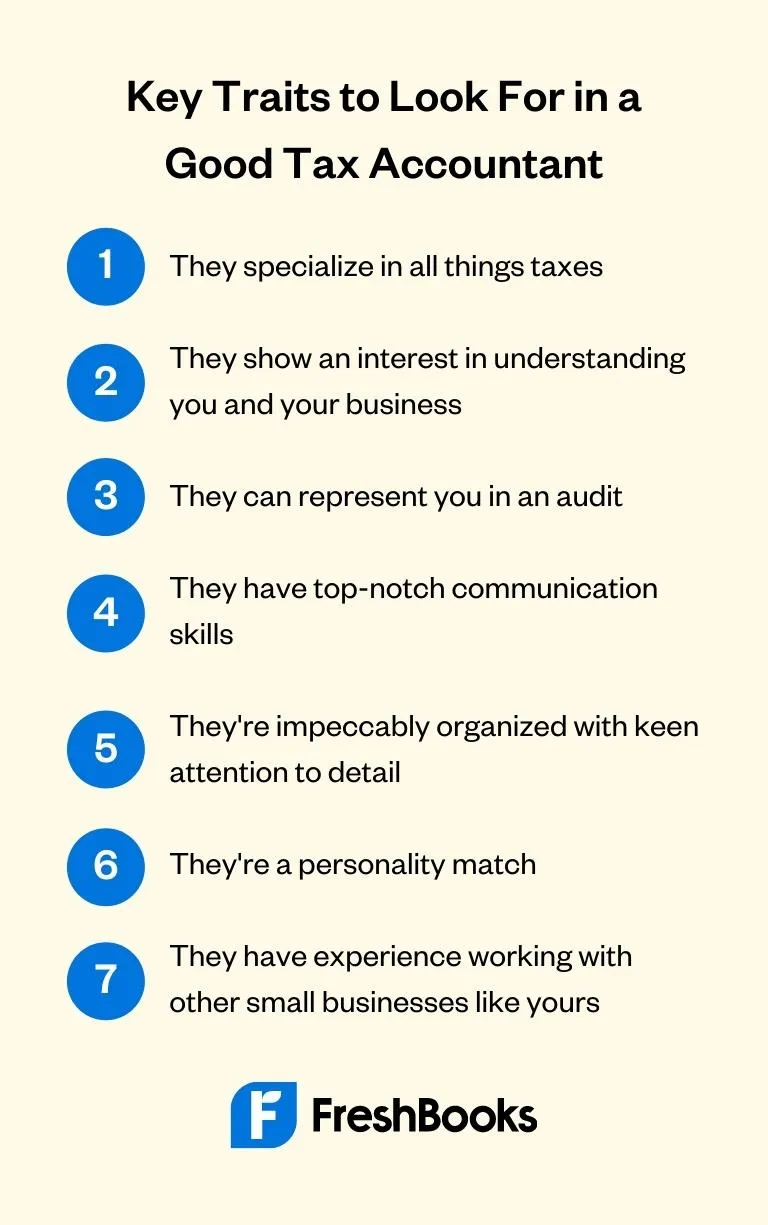

The Key Traits You Should Look for in a Good Tax Accountant

Before you hire a professional to do your business taxes, it’s important to know what the ideal professional actually looks like.

There are a few key traits you should look for in a good accountant, including that they:

1. Specialize in All Things Taxes

Just because someone has the title “accountant” doesn’t mean they’re the right person to do your business taxes.

As mentioned, business taxes are extremely complex and always changing. When you hire an accountant, you want to make sure they specialize in taxes and understand any recent or upcoming changes to the business tax landscape.

2. Show an Interest in Understanding You and Your Business

The last thing you want is an accountant who takes a one-size-fits-all approach to working with their clients. Every business (including yours!) is different and, as such, presents a different set of challenges come tax time.

The right tax professional will show a genuine interest in understanding you and your business. They’ll ask questions, dig into your financials and come up with solutions that help you get the most from your business taxes.

The more they understand you and your business, the better they can do their job—and the easier the process will be for both of you.

3. Have Experience Working with Other Small Businesses

Not all business taxes are created equal; filing taxes for a large corporation is completely different from filing taxes for a small business.

Accountants who specialize in small business taxes will bring a higher level of understanding and expertise to the table, which can make getting your taxes done an easier and less stressful experience.

4. Are Impeccably Organized with Keen Attention to Detail

Business taxes are a big job with a lot of moving parts. There’s information to gather, forms to fill out, deadlines to meet … it’s a lot to keep track of, which is why it’s so important to hire an accountant who is incredibly organized with a keen attention to detail.

As mentioned, making mistakes on your taxes can cost your business big-time. So when you hire a tax accountant, you need to feel confident that they can manage the entire process from beginning to end. And, more importantly, that they can manage the process without making any mistakes.

A good accountant will have a foolproof organizational system for managing their clients come tax time—including going through every form with a fine-tooth comb to make sure no i’s are left undotted or t’s uncrossed.

The right tax accountant will show a genuine interest in understanding you and your business. They’ll help you get the very most from your business taxes.

5. Have High-Level Communication Skills

Obviously, you need to hire a tax accountant who is great with numbers. But slightly less obvious is that you need to hire a tax accountant with excellent communication skills.

Getting your taxes done can be a complex, drawn-out and sometimes stressful process. And that process will be immeasurably more stressful if you work with an accountant who doesn’t communicate with you.

A good accountant should foster open communication, keep you up-to-date on what’s going on with your taxes and make themselves available to answer any questions you might have about the process.

6. Are a Personality Match

You’re going to be working closely with your accountant throughout tax season and possibly throughout the year. So why not work with someone you like?

Finding a tax accountant that you get along with can make the process of doing your business taxes a much more enjoyable experience.

You don’t have to be BFFs or anything like that, but if you can find an accountant whose personality meshes with yours, it’s definitely a bonus.

7. Can Represent You in an Audit

In a perfect world, you wouldn’t get audited—especially after you hire an accountant to manage your taxes. But we don’t live in a perfect world, so when you hire a tax accountant, you want to make sure they have the necessary credentials to represent you in an audit.

There are three types of tax professionals who can represent you in an audit: a certified public accountant (CPA), an enrolled agent (EA) or an attorney. If you hire a professional without one of those credentials, you run the risk of having to handle the IRS on your own.

How to Find a Good Accountant

Once you decide you need an accountant (and you know the traits you should look for), it’s time to actually go out there and find them. But how, exactly, do you do that?

There are a few different avenues you can explore to find a top-notch tax accountant, including:

1. Ask for Referrals

Getting a referral from someone you know and trust is one of the best ways to find a quality account. Tap into your network and ask your colleagues, friends, and family if they have any tax accountants they can recommend.

2. Tap into Professional Organizations

Professional organizations are another great place to find qualified accounting professionals.

Reach out to your local Chamber of Commerce for a list of local tax accountants or tap into one of the many professional networks (like the National Association of Tax Professionals, the National Association of Enrolled Agents or the American Institute of Certified Public Accountants) that cater to tax professionals.

3. Seek out Experts/Thought Leaders

In addition to providing tax preparation services, there are plenty of tax accountants out there who go the extra mile to establish themselves as finance leaders or thought experts in the space. For example, an accountant might write a tax advice column for the local paper or host a blog on all things business finance.

If someone does the work to provide education and information to the public (and you find that information helpful), consider them an option worth exploring.

4. Read Online Reviews

You should always take online reviews with a grain of salt. But if there’s a local tax professional with hundreds of five-star reviews across Yelp, Google and other review sites, they at least warrant an exploratory phone call. (Bonus: Online reviews can also give you insights into tax professionals you don’t want to work with.)

How to Vet Your Tax Accountant

Once you’ve got a solid list of potential tax professionals, you need to vet them to figure out which are the best fit for you.

To vet your tax accountants, you’ll need to:

1. Figure out the Best Type of Tax Professional for You

As mentioned, there are three types of tax professionals you’ll want to consider for your business taxes: CPAs, EAs, and attorneys. None of them are necessarily “better” than the other, but understanding the differences can help you figure out the best tax professional for you and your business.

- Enrolled agents (EAs) are tax professionals that go through a licensing process with the IRS (which includes thorough background checks, an exam or at least five years of experience working at the IRS and continuing education requirements). The benefit of working with an EA is that their business is focused entirely on taxes (unlike CPAs and attorneys, who may also practice in other areas)

- Certified Public Accountants (CPAs) are accountants who have been certified by the state after passing their qualifying exams and satisfying their education and experience requirements. CPAs are true professionals when it comes to accounting and can often advise you on other financial issues. Not all CPAs, however, specialize in taxes, so it’s important to ask about their experience with small business taxes before you work with them

- Tax attorneys are lawyers who specialize in tax law. While having an attorney prepare your taxes is often unnecessary (and more expensive than other options), they can definitely be helpful if your taxes are extremely complex or you’ve had issues with the IRS in the past

2. Write Your Interview Questions

Before you start talking to tax professionals, you need to know what you’re going to say. Writing out your interview questions ahead of time will ensure you get all the information you need to make an informed decision on whether an accountant is a right fit for you and your business.

Some questions you should consider asking during your accountant interview include:

- What do your services include?

- Do you have experience working with small businesses?

- Do you have experience within my industry?

- What are your fees?

- How do you bill for your tax preparation services? (e.g., is there an upfront cost or do you pay for your taxes upon completion?)

- What’s your preferred method of communication? How long does it take for you to respond to e-mails, phone calls, etc.?

- Are there any other financial services you offer to small businesses? If so, what are they? (Only relevant if speaking to a tax attorney or CPA)

- Will you represent my business in the event of an audit?

3. Interview Multiple Accountants

Once you know what kind of tax professional you want to work with—and what questions you want to ask—it’s time to actually start the interview process.

In order to get a real sense of what’s out there and what different professionals have to offer, you should plan on interviewing multiple accountants.

While there’s no magic number, interviewing four to five accountants will give you plenty of information to work with and help you better evaluate each tax professional.

4. Ask for Client Referrals

Any tax accountant you speak to is going to try to sell you their services. So even if they say everything you want to hear, you need to take it with a grain of salt.

Asking for client referrals is a great way to get better insight into what it’s actually like to work with that tax accountant. Former and/or current clients can tell you about their communication style, the quality of their service and any issues they had during their working relationship.

Any good tax accountant will be confident in their clients’ satisfaction and happy to put you in touch with them. If they’re not and refuse to connect you with any of their former or current clients consider it a red flag.

Choosing the Right Tax Accountant for You

You’ve narrowed down the pool of potential tax accountants. You’ve interviewed them, asked for references, and reviewed their credentials and services. But how do you choose the right accountant for you?

If you can’t decide which tax professional is right for you, some additional factors you might want to consider include:

1. Fees

The cost shouldn’t be the only factor you consider when choosing a tax accountant—but it certainly plays a part. While you don’t want to cut corners when it comes to doing your business taxes, you also don’t want to put yourself in debt. Make sure when you’re hiring a tax accountant that their fees are in line with your budget.

2. Availability

Some accountants get completely swamped during tax season and might not have the availability to give your taxes the time and attention they deserve. Before you hire a tax accountant, make sure to ask about their availability, the speed of their communication (you don’t want your e-mails to go unanswered for days!), and how much time they have for things like reviewing paperwork or answering tax-related questions.

3. Experience with Your Industry

While a tax accountant doesn’t need to have experience within your industry, it certainly doesn’t hurt! If you’re having a hard time narrowing down potential tax accountants, experience within your industry should definitely move an accountant further up the list.

Know the Traits to Look for in a Tax Accountant—and Use Them to Find the Right Tax Accountant for Your Business

Not every small business wants or needs to hire an accountant to handle their taxes. But if you do need a little extra support when tax time rolls around, you now have the tools you need to find, vet and hire the best accountant for you and your business.

This post was updated in January 2022.

Written by Deanna deBara, Freelance Contributor

Posted on December 11, 2019

This article was verified by Janet Berry-Johnson, CPA and Freelance Contributor

Your Complete Guide to Small Business Tax Credits

Your Complete Guide to Small Business Tax Credits Everything You Need to Know About How to Lower Self-Employment Taxes

Everything You Need to Know About How to Lower Self-Employment Taxes Bookkeeping vs. Accounting: What’s the Difference, Anyway?

Bookkeeping vs. Accounting: What’s the Difference, Anyway?