As the COVID-19 storm starts to calm, how can businesses get back on their feet?

The fact that things are starting to reopen is exciting, but also daunting, considering that many businesses have made drastic changes to adapt to the rules and regulations of the pandemic.

Seen through a different lens, though, this changing environment can be an opportunity to take your business from simply surviving the pandemic to thriving. With proper assessment and planning, your business can bounce back, minimize the impact of another crisis and remain resilient no matter what comes your way.

If you’re not sure where to start, this framework will help get your business back on track.

Table of Contents

Assess the Damages

The first step in rebuilding is to determine precisely how your business has been affected by COVID-19. This means that all financial statements and items—such as cash flow, expenses, and income statements—should be analyzed and compared to previous years. A comparison will help determine the actual damages incurred during the pandemic.

Also, consider losses such as office space, employees, and any accompanying expenses (salaries, rent, utilities, etc.)

This step can be difficult, and even painful to reflect on, but it is necessary to rebuild your business and prepare for the post-COVID world.

Define the Current Situation

Now that you’ve determined the damages that COVID had on your business, it’s time to outline what your business has done to adapt to the pandemic. Because of how rapidly businesses evolved to the ever-changing regulations, many financial and logistical changes need to be documented to be ready to reopen post-COVID.

For example, let’s look at remote working. How many employees have you onboarded? What does this process look like? Will you continue having employees work remotely, or will you be opening an office again?

Another factor to consider is additional marketing and sales channels that your company is now engaging in. For example, many businesses have revamped their websites, started advertising and actively posting on social media and Google, and partnered with other small businesses in giveaways or other initiatives.

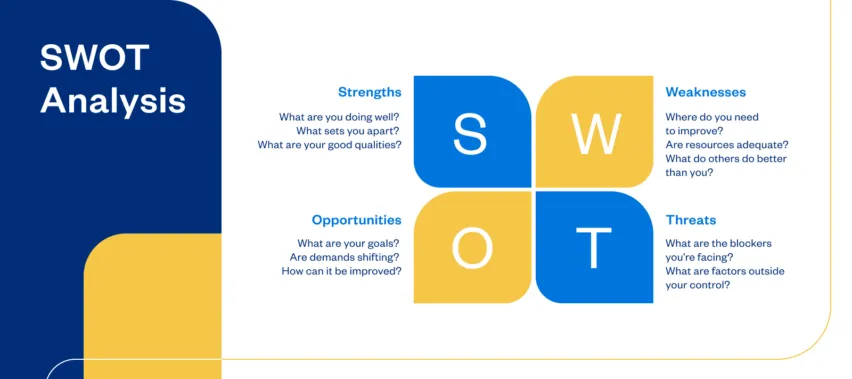

When entering into post-COVID, you must determine how your business will change, if at all. This will help give a clear direction of how your business will operate and set you up for success. Conducting a SWOT analysis of the current situation is a helpful (and recommended) framework to assist in defining the current situation and assist in determining a game plan for the future.

Create a Game Plan

Now it’s time to create a plan that will successfully launch your business into the post-COVID world.

Review Channel Strategies

Your business likely expanded into new digital channels during the pandemic. If not, now is the time to take advantage of these opportunities, especially in a post-pandemic environment.

Studies have shown that 81% of customers research online before purchasing a product or service. This means before you’ve even spoken to a client, it’s likely that they’ve already done research on your offerings and formed an opinion about your business.

Email is a channel that your business may want to explore or double down on. It’s often neglected and may not seem necessary. However, email is nearly 40x more effective than either Facebook or Twitter when it comes to customer acquisition. Think about this when strategizing your email strategy.

You can utilize email marketing through:

- Newsletters

- Cold outreach

- Giveaways

- Seasonal promotions and discounts

Rebuild Your Workflows

When conducting a SWOT analysis, weaknesses that you may not have been aware of likely become evident—which is completely normal! The next step is to ensure that workflows have adapted to these changes and you’re equipped with the tools to support your processes as things start to open up and likely get busier.

A workflow you should consider rebuilding first is invoicing and payments, since it’s vital to your business. Starting here will help you get paid faster and make things more convenient for your clients. Not only does this provide financial stability, but getting these workflows in order will save you time from consistently following up with clients to fulfill invoices and can even benefit your client relationships.

Revamp the Budget

Post-COVID, it’s likely that your business will start picking up, and employees (and customers) may have certain expectations about going into the office or work-from-home support. So it’s time now to determine exactly where your money is going.

For example, you may decide to open a physical office again, which means the budget will now need to account for rent, office equipment, utilities, internet, etc.

Once you have a clear idea of what expenses need to be budgeted for, you can review and determine where costs can be reduced. The goal is to eliminate unnecessary expenses and create a lean operational budget to achieve saving and investment goals.

Develop a Timeline for Rebuilding

At this point, you likely have a long list of “to-dos” to prepare for the post-COVID world. It can be tempting to cross as many items off as quickly as possible. However, it’s best to create a realistic timeline—as this will help you achieve goals in a productive manner and avoid burnout.

Create a timeline that prioritizes the most important tasks first, and remember to track your progress, even if they seem small. This is especially important when determining if your budget is realistic, providing clear insights into cash flow and actual expenses. This is also applicable to your workflows—identifying bottlenecks and areas of improvement.

Create a Crisis Recovery Plan

No one could have predicted a worldwide pandemic, and it’s likely that you won’t be able to predict when the next crisis will occur. However, you can prepare and create a crisis recovery plan to ensure your business withstands whatever comes next.

Using the many lessons learned throughout COVID-19 is a great starting point to crisis-proofing your business. For example, creating an emergency fund may be a priority if keeping up with expenses was a struggle. Or you may need to document and create a plan to support staff transitioning to remote working while keeping costs under control.

Having a crisis recovery plan will help your business survive the next unexpected event, no matter when it occurs.

Make Post-COVID the Best Season for Your Business

There is lots to consider when navigating the post-COVID world—but you’ve come this far, and by taking the proper next steps, your business can run smarter and more financially sound than ever before.

And the good news is that you now have the framework needed to take your business from surviving to thriving, no matter what life throws at you.

To recap the framework, remember to:

- Assess the damages: What financial damages were incurred? Did you lose an office? Employees? Any other resources?

- Define the current situation: Document what your business has done to adapt to COVID-19.

- Create a game plan: Review channel strategies, rebuild workflows, revamp the budget, create a timeline, and GO!

- Create a crisis recovery plan: Ensure your business is ready for the next crisis.

Webinar | Beating the Odds as a Woman in Business: How to Fund and Scale Like a Boss

Written by Megan Smith, Freelance Contributor

Posted on August 2, 2021

Create a Small Business Budget in 5 Simple Steps

Create a Small Business Budget in 5 Simple Steps 10 Advanced Invoicing Tips to Get Paid Even Faster

10 Advanced Invoicing Tips to Get Paid Even Faster New: Features to Help Your Business Through COVID-19

New: Features to Help Your Business Through COVID-19