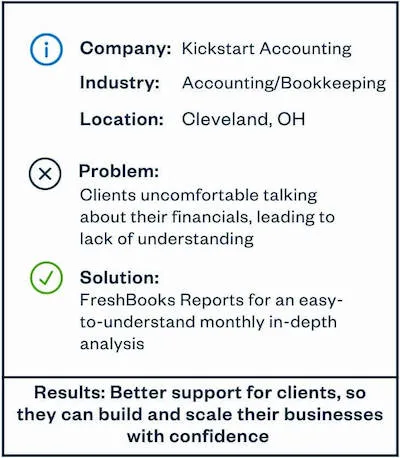

Lindsay Darby of Kickstart Accounting helps women entrepreneurs understand their finances and grow their businesses. FreshBooks makes that easier for her and her clients.

“She said, ‘Hey, I have this crazy idea. What do you think?’” recalls Lindsay.

Danielle had learned about an outsourced bookkeeping startup out of Columbus, Ohio, and wanted to replicate the concept in Cleveland. By then, both women had years of experience working as accountants for companies and firms of all sizes, but neither had run their own business.

Lindsay didn’t give it much thought before agreeing. “Sure,” she said.

It wasn’t until days later, when Danielle followed up, that reality set in. “I was like, ‘Oh crap, what did I agree to do?’” says Lindsay, with a laugh. “That’s been our journey ever since.”

While Kickstart Accounting may have had a haphazard start, its growth has been anything but. Now employing 10 full-time bookkeepers, the virtual accounting firm specializes in helping entrepreneurs—from the self-employed to those with multi-million-dollar revenues—better understand their finances so they can scale and grow.

We spoke with Lindsay to learn more about how Kickstart Accounting works with small business owners, and how FreshBooks helps her team do it.

What sets Kickstart Accounting apart from your competition?

Lindsay: We view ourselves as an additional resource and an extension of your team. We’re just not going to do your numbers and say, “Thank you. See you next month or next year.”

We really do want to go along with you on this journey and be a part of your team. So, when you want to expand, we’re helping you crunch those numbers. Or, if you want to hire, we’re helping you make sure that you can truly afford it. We really pride ourselves on being that business partner to help you grow. Our goal is to help you outgrow us.

I love that FreshBooks is asking for feedback from accountants who are actually using it, as opposed to just going with whatever developers think is right.

You support a lot of women-owned businesses. Why is this an area of focus for you?

Lindsay: Early on, when we were still in the networking stages, we found there were so many women who would refuse to talk about their numbers. There’s definitely a mindset block when it comes to women and money. I think it stems from the fact that we are taught at a young age that talking about money is a taboo or personal topic and we should not be talking to anyone else about our finances.

As a woman who works in accounting, money, and finance, it would frustrate me to no end. How are you ever going to grow your business if you have no idea what’s going on? If you have no idea that if you’re selling an item at a loss, you’re not going to stay in business long-term.

So, we focus on helping other women get over that fear, get over that hump, so they can make better-informed decisions and continue to grow their businesses. As they grow, we go right along with them.

Why did you decide to start using FreshBooks to support your clients?

Lindsay: I was Googling one day, and I came across FreshBooks and thought, “This is new, this is different.” We had already been using original FreshBooks to do our own invoicing. So, when I saw that now they were offering accounting tools and not just invoicing, I really wanted to learn more about it and see if it would be beneficial to any of our clients.

I thought it would be a good offering for some of our newer, just starting-out clients. It is much more affordable compared to some other software. The price point is a huge difference, especially if you’re working with clients at more of the startup stage—and it definitely gets people out of Excel.

I feel like you’ve transformed their life. Like, instead of trying to remember, “Where’s that receipt?” An expense can be recorded automatically by linking your bank and you don’t have to worry about it. It just takes so much off of their plates.

How do you use FreshBooks with your clients?

Lindsay: So, we do the bookkeeping for our clients because we like to make sure everything is right and ready to go for them to file their business taxes.

We use FreshBooks to pull reports for our clients, like standard balance sheet and income statements. Our analysis comes with the reports, to help tell the story of what they’ve been up to for the month.

That includes KPIs (key performance indicators) that are specific to each business and industry, how sales and income are comparing to prior year, biggest expense categories for the month and year-to-date categories, and what we think they should have set aside for taxes for year-end.

You work with several accounting platforms. How is FreshBooks different?

Lindsay: What I really love is being on the Accounting Partner Program Partner Council. I love that FreshBooks is asking for feedback from accountants who are actually using it, as opposed to just going with whatever developers think is right.

And, when I don’t understand things, I can take it to the certified FreshBooks partners and say, has anyone encountered this before? How have you handled it? So we bounce ideas off of each other. Then if there’s no good solution, we can submit a ticket and get it to FreshBooks developers and Product Design team and get something in the works. I think that’s truly what sets FreshBooks apart.

How does FreshBooks’s Accounting Partner Program help support your firm?

Lindsay: I just really love being able to bounce ideas off the other accountants. The other FreshBooks Accounting Partners have been so helpful. I’m currently working on an intense cleanup, so I have asked several questions in our community channel and I’ve received great feedback from them—and from the FreshBooks Accounting Specialists.

It’s been really collaborative. And Twyla [Verhelst, Head of the FreshBooks Accountant Channel] has been super involved. She has an accounting background and she’ll often pitch in with her 2 cents.

It’s been super beneficial and I truly love it.

🚀 Are you an accountant or bookkeeper? Find out more about the FreshBooks Accounting Partner Program.

Written by Jessica Wynne Lockhart, Freelance Contributor

Posted on November 4, 2021

![The 5 W's of Scaling Accounting Advisory Services [webinar]](https://www.freshbooks.com/blog/wp-content/uploads/2021/04/hero-accounting-webinar-5ws-advisory-226x150.png)