Invoice Software That Gets Your Billing in Order

Simplify your small business invoicing and billing to take back 550 work hours a year. Our online invoice tracking software results in faster payments, giving you more time to grow your business.

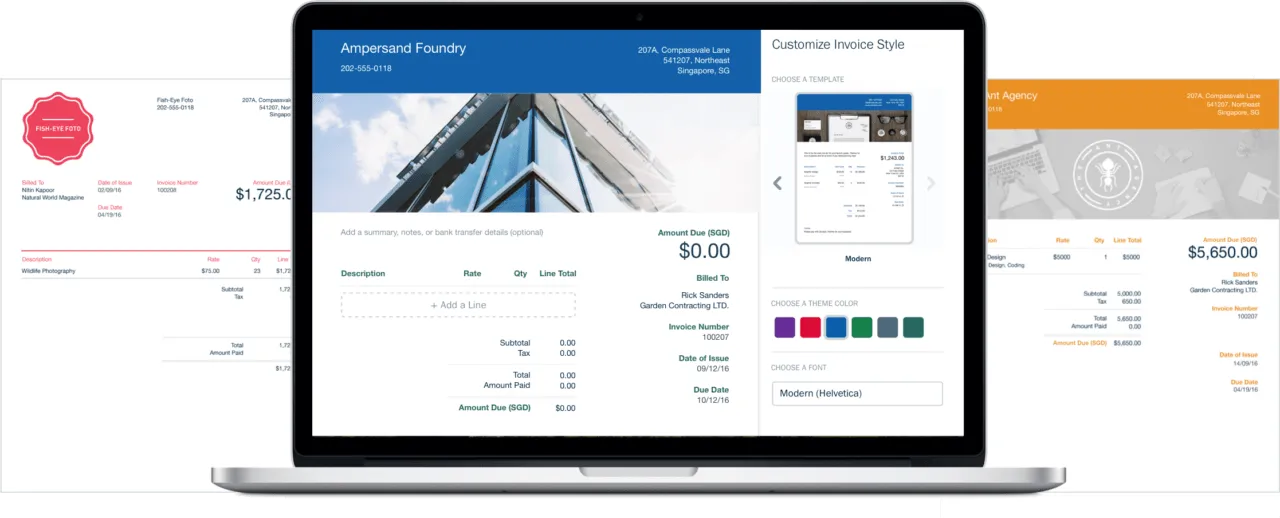

Create Professional-Looking Invoices in Seconds

You’re the real deal, be sure you look it. Sending professional-looking invoices that use your logo and branding is ridiculously easy, thanks to the FreshBooks online invoice generator.

Accept Credit Cards and Get Paid Faster

No more chasing clients for payment or waiting in line at the bank. Send invoices and let your clients pay their preferred way, online, and get paid up to 11 days faster.

Put Your Business on Auto‑Pilot

The best invoice software programs, LIke FreshBooks, send overdue invoice reminders, charge credit cards and more. With built-in automation, FreshBooks invoice software does the leg work for you.

Get Paid Upfront With Deposits

Forget floating expenses or being reimbursed at the end of a project. Request an invoice deposit and sleep better with more money in the bank.

Bill For Exactly What You’re Worth

Charge for ALL work and expenses using custom invoices. FreshBooks Invoicing makes it easy to add tracked time and expenses to invoices so money is never left on the table.

Establish a Stable Cash Flow with Retainers

Negotiate fixed pricing with your clients upfront. Whether it’s by timeline or project, retainers make it easier to forecast workload and income.

Manage Timelines Effectively

Dedicate a specific number of hours to your client’s retainer and schedule work against that amount at a pace that’s good for both of you.

Create Professional Reports

Keep your clients happy and informed by using FreshBooks invoice software to send retainer summary reports at any point during a retainer period.

Tame Scope Creep

When project deliverables change, it’s easy to highlight what’s new and discuss the impact on your retainer amount and timeline.

Streamline Your Workflow

Recurring invoicing, time tracking, project management and reporting all seamlessly work together in this easy-to-use invoicing and billing software.

Even More Powerful Invoicing Features

- Add invoice due dates

- Customise invoice payment terms

- Create recurring invoices

- Easily offer discounts

- Automatically calculate taxes

- Preview invoices before sending

- Choose your preferred currency

- Instant updates when an invoice has been viewed and paid

- Send automatic payment reminders for overdue invoices

- Invoice from anywhere with the mobile app

- Automatically track inventory billed on invoices

See other powerful features to help you invoice like a pro >

Did You Know…

Frequently Asked Questions

Invoicing and billing are easy with the FreshBooks invoice maker. Create a new invoice from your Dashboard by clicking “Create New” and then clicking “Invoice”. You can also create a new invoice from the “Invoices” section by clicking “New Invoice”.

For more information about creating a professionally designed invoice, creating line items, creating an invoice number, how to send invoices, and how to get paid with online invoicing software, click here to learn more about getting paid with FreshBooks invoicing software online.

Also, check out this link for even more information about FreshBooks invoicing and billing software, how to send invoices, and get paid using FreshBooks.

Get a quick rundown of invoicing on FreshBooks in this 30-second video.

Essentially, an invoice and a bill communicate the same information and both work to help you get paid. Both can be created with online invoicing software, and both have line items about the sale of products or services, a due date, payment terms, sales tax or other tax, among other things. The main difference between invoicing and billing is that an invoice is generally used by a business to get paid by clients, whereas a bill is used by a customer to refer to payments (online or physical) they owe suppliers for their products or services. An invoice and a bill are essentially the same things, but the two terms are simply used by the different parties involved in the same transaction.

Wondering how much you can save using FreshBooks for billing and invoicing? Read this case study: Tech Company AppSmart Saves $18,000 Annually by Using FreshBooks for Billing

There are a few payment gateways with different options that can all help you accept credit card payments and get paid: Stripe & PayPal.

Enabling online payments in FreshBooks billing and invoicing software is easy, just read this article for details. Or watch this cool video about how easy online payments are in FreshBooks.

You can’t get paid without invoicing, which is why using invoicing software and accepting payments needs to be a seamless experience. Accepting online credit card payments with invoicing software is key to getting paid faster. You can opt to accept credit card payments directly on your invoice when you create a new one, and it’s easy for clients to pay you this way.

Check out this article about online payments: Accepting Online Payments Will Help You Scale Faster, Smarter

Payment Schedules in FreshBooks allow you to create a payment plan for your clients, so they can pay Invoices in multiple and partial instalments according to your payment terms. This saves you from having to create multiple Invoices or continually editing an existing Invoice whenever a new payment is due.

Partial Payments in FreshBooks allow you to accept payments that are less than the full invoiced amount so clients can pay a custom amount up to the total invoice amount. You can allow for partial payments in your invoice software settings. This gives your client flexibility in picking the payment amount.

While there are lots of free invoice template options and invoice generator options out there, using them can be an arduous experience, packed with ads and other barriers. Creating Recurring Invoices in FreshBooks is easy. These Recurring Invoices are automatically generated in the invoice software based on the due date and schedule you choose. Recurring invoicing is the perfect way to invoice subscription-based clients that need ongoing work. Essentially, recurring invoicing is a hands-off invoicing software solution.

Creating recurring invoices in FreshBooks billing and invoicing software is easier than you think—read this article for more.

You can save your professional invoices by downloading them as PDFs and then emailing them to clients, but the easiest way to send invoices is right on the FreshBooks platform. FreshBooks invoicing and billing software lets you send invoices right from your account. So while you can download an invoice PDF or copy and paste a shareable invoice link, you can send professional invoices right from FreshBooks with a single click. Here’s the full article about sending invoices with the FreshBooks online invoice generator.

Clients receiving an invoice with line items for subscription-based products or services will find it easy to save their credit card, banking or other payment details on the FreshBooks invoice software so they’re automatically billed each time an invoice comes due. Imagine doing this without invoicing software—dealing with paper invoices and receipts and having to keep track of phone and address records separately.

Automatic invoicing in FreshBooks with Recurring Payments makes it simple for clients to pay and for you to accept payments for products or services rendered. Recurring Payments works together with Recurring Templates to automatically bill clients every time an invoice is generated and sent.

Saved payment information can always be removed if your clients want to opt-out of Recurring Payments at any time. Click here for all the details about saving payment information with Freshbooks billing and invoicing software, and make unpaid invoices a thing of the past.

Ready to get paid faster? Use your invoice payment terms to get paid faster.

Take the guesswork out of invoicing with FreshBooks.

Check out how to keep your expenses effortlessly organized with FreshBooks, or learn more about us