How to Pay Bills on Time: 7 Tips to Keep in Mind

Paying bills on time is an essential part of managing your finances. It helps you maintain good credit, control your spending, and avoid late fees or other penalties. By creating a plan for how you will pay your monthly bills, you ensure you have enough money for all the things you need while steering away from debt.

Here are some tips to help you stay on top of your finances and settle your bills regularly.

Table of Contents

7 Best Ways to Pay Your Bills on Time

7 Best Ways to Pay Your Bills on Time

Organize Your Bills

An essential part of paying bills on time has an organized system. To start, make a list of all the bills that need to be made each month. This could include rent/mortgage payments, utilities, car payments, loan payments, and property maintenance costs.

For best results, you should separate your bills into two categories: those that can be processed automatically and those that can’t. Next, prioritize these bills according to their importance and due dates so, you know which ones need to be paid first. Don’t forget to review your statements regularly for any changes and file the bills you paid to keep a record.

FreshBooks has an accounts payable feature to help you organize your bills in one convenient place. This allows you to track when bills are due, what they are for, and how much you owe. This can help reduce the stress associated with bill payment and ensure nothing slips through the cracks.

How Do I Create A Bill on FreshBooks?

- Log into your FreshBooks account.

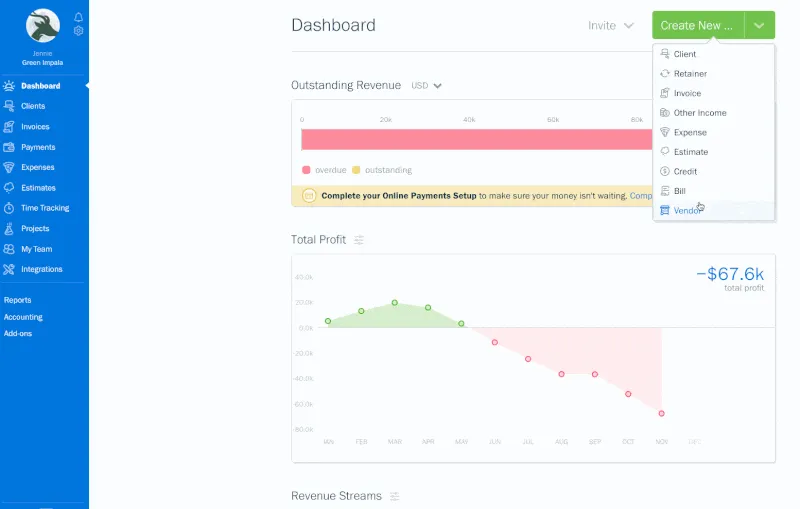

- On the Dashboard, click on the Create New… button, then select Bill.

- Here you can add a Vendor to the Bill, then enter its details.

- When you’re done, click on the Save button to finish.

Similar to invoices, you can assign each line item of the Bill to a specific category, track any taxes, and note when the Bill needs to be paid by. Here’s what it looks like in-app:

Check Your Due Dates

Make sure to check the due date for each bill before making the payment and note it on your calendar or planner if possible. Missing the due date can lead to penalties or even disrupt service delivery. You can even set up reminders for specific creditors or lock in automatic payments from your bank account balance.

Create a Calendar for Your Payments

One of the best ways to ensure all of your bills are settled on time is by creating a calendar specifically devoted just to them. This will help break down larger monthly expenses into smaller sections that fit within your budget better so that they don’t feel overwhelming when they come due all at once.

Decide How Much You Will Pay

When it comes to paying your bills on time, deciding how much you should pay is just as important as when you should make the payment. Start by evaluating your current monthly expenses and income to get a better sense of what you can afford. Identify fixed and variable expenses, such as rent or mortgage payments, utility bills, online services, and credit card payments.

Once you know these amounts, create a budget that works for you by allocating a percentage of your income toward bills each month. Consider setting aside money in an emergency fund in case of unexpected costs.

Decide What Payment Method Is Best for You

There are many different ways of paying your bills, from writing a paycheck to using online banking services or even automated clearing house (ACH) systems for direct payments from your bank account.

However, it’s important to establish the pros and cons associated with each payment method. This can help you decide which one is best for you based on convenience and cost efficiency. When considering traditional methods such as checks and money orders, ensure you allow sufficient time for delivery.

Online banking facilities typically provide more features like automated bill payment options, which can help avoid missed payments. Additionally, some companies may offer rewards programs that allow customers to earn points or cash back when making certain types of purchases or bill payments. This could be a great way to save money while paying your bills promptly.

Automate Payments Whenever Possible

If possible, automate your bill payments through electronic means such as debit cards, ACH transfers, and other payment methods. This way, you won’t forget to make payments on time. In addition, automatic payment creates fewer opportunities for data entry errors.

Consider Consolidating Debts

If multiple debts are causing problems when trying to manage expenses, consider consolidating into one loan with a lower interest rate or better terms. You can extend the repayment periods over a longer period and reduce the amount payable each month.

4 Ways to Pay Your Bills

Here are four convenient ways to pay your bills that can help make sure you never miss a payment.

Pay Online

One of the most popular ways to pay your bills is online. This method is fast, easy, and secure. Many lenders offer online bill payment options through their websites or mobile apps. All you need to do is enter your bank details and the bill amount, and the payment will be processed immediately.

This method also allows you to set up autopay for regular payments, so you don’t have to worry about paying manually every month.

Direct Debit

Direct debit allows you to set up a recurring payment on a weekly, monthly, or yearly basis. This way, you’re able to settle your bills immediately. To use this method, you just need to provide your bank details and the amount you want to pay each time. On the due dates, the specified amount will automatically be deducted from your account balance.

Credit Cards (Short-Term Debt)

Using a credit card to pay monthly bills is another easy way to stay on top of your financial obligations. Credit cards are a good option when your bank balance runs low. For example, you can negotiate with the creditor and break down the full balance due into several payments. In addition, most creditors offer cardholders a variety of benefits, including reward points, cash back, and free travel that can help offset costs.

By Post

You can also pay by post if you prefer not to use an online system or direct debit option. All you need to do is write out a paycheck for the exact amount due and mail it off in an envelope. One disadvantage of this method is that the money takes longer to arrive than direct debit and online payments. On the upside, it reduces the likelihood of making errors or leaving out important information.

Key Takeaways

To remain in control of your bills, organize them into a comprehensive list, check their due dates, and create an effective system for tracking upcoming payments. For example, you can set reminders using the Google Calendar app on your phone.

In addition, you should choose a payment method that works best for your situation and automate as many transactions as possible. Automated credit or debit card payments are especially helpful for regular bills that are due at the same time each month.

FAQs on How to Pay Bills

How can I pay bills with no money?

You can ask family or friends for help, contact creditors, or search for government assistance programs.

What happens if you cannot pay bills?

If you cannot pay bills, you may end up in debt. This can lead to wage garnishment, liens against your business or property, or even bankruptcy.

Is it better to pay bills early or on time?

It’s always better to pay up early. If you can’t pay all of them at once, try to at least make a dent in the amount you owe. Most companies add a late fee for the next month if the invoice is paid past the schedule.

What is the safest way to pay your bills?

Using a credit card is one of the safest ways to pay your bills. If problems arise, you can dispute the charge with your credit card company. Additionally, many credit cards offer fraud protection in case your card is stolen or used without permission.

RELATED ARTICLES